Managing money effectively is one of the most essential life skills, yet many people struggle with budgeting, tracking expenses, and saving. The good news is that mobile apps are making this process easier than ever. One standout option is Qashu App, a powerful offline budgeting tool designed to simplify personal finance for individuals and families.In this article, we’ll explore what makes Qashu unique, why offline budgeting matters, and how you can use it to take control of your finances.

Why Offline Budgeting Matters

While most finance apps rely on internet connectivity, Qashu stands apart by offering offline-first features. This means you can manage your money anytime, anywhere—without worrying about unstable networks or data security.

Key benefits of offline budgeting:

-

Enhanced privacy: Your financial data stays on your device, safe from online risks.

-

Convenience: No internet? No problem. You can still record income and expenses.

-

Control: Offline tools encourage mindful spending and direct involvement in budgeting.

Learn more about the importance of budgeting.

Qashu App: Features That Make It Stand Out

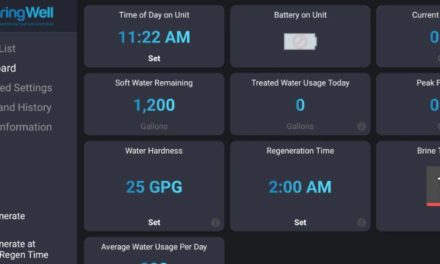

1. Simple Income & Expense Tracking

Qashu allows you to quickly log your daily income and expenses with user-friendly input options. Categories make it easier to analyze where your money goes.

2. Budget Customization

Set monthly or weekly budgets tailored to your lifestyle. The app notifies you if you’re close to overspending, helping you stay on track.Check out our Android Apps Category

3. Insightful Reports

Get a clear view of your financial health through charts and summaries. These insights make it easier to identify spending patterns.

4. Offline Reliability

Unlike cloud-dependent apps, Qashu ensures your data is always accessible—even without the internet.

5. Security First

By working offline, Qashu minimizes risks of hacking or data breaches, giving users peace of mind.For more tips on staying secure, see NerdWallet’s guide to budgeting apps.

How Qashu Simplifies Your Financial Life

-

No distractions: Focus solely on money management without app advertisements or unnecessary features.

-

Beginner-friendly: Even users new to budgeting can adapt easily.

-

Consistency: Daily use becomes a habit, improving financial discipline.

You may also like: Best Android VPN Apps for Privacy.

Tips to Get Started with Qashu

-

Download the app from the official store.

-

Set your first budget by estimating your monthly expenses.

-

Log every expense daily—even small ones like coffee.

-

Review reports weekly to see where adjustments are needed.

-

Stay consistent for at least 3 months to build strong financial habits.

For a deeper dive into money habits, check Forbes Finance Tips (external).

FAQs on Qashu App and Offline Budgeting

1. What is Qashu App used for?

Qashu is a personal finance app designed for offline budgeting, income tracking, and expense management, helping users gain full control over their money.

2. Is Qashu safe to use?

Yes. Since Qashu works offline, your financial data stays private on your device, reducing risks of cyber theft or online tracking.

Related: AI-Powered Mobile Security Apps.

3. Can I use Qashu without internet?

Absolutely. One of Qashu’s biggest advantages is that it functions 100% offline, making it ideal for users in areas with poor connectivity.

4. How does Qashu help with saving money?

By tracking income and expenses in detail, Qashu identifies overspending patterns and encourages smarter financial planning and savings.Check out Mint’s beginner guide to budgeting.

5. Who should use Qashu App?

Anyone—from students and professionals to small business owners—can benefit from Qashu’s simple, secure, and effective budgeting tools.