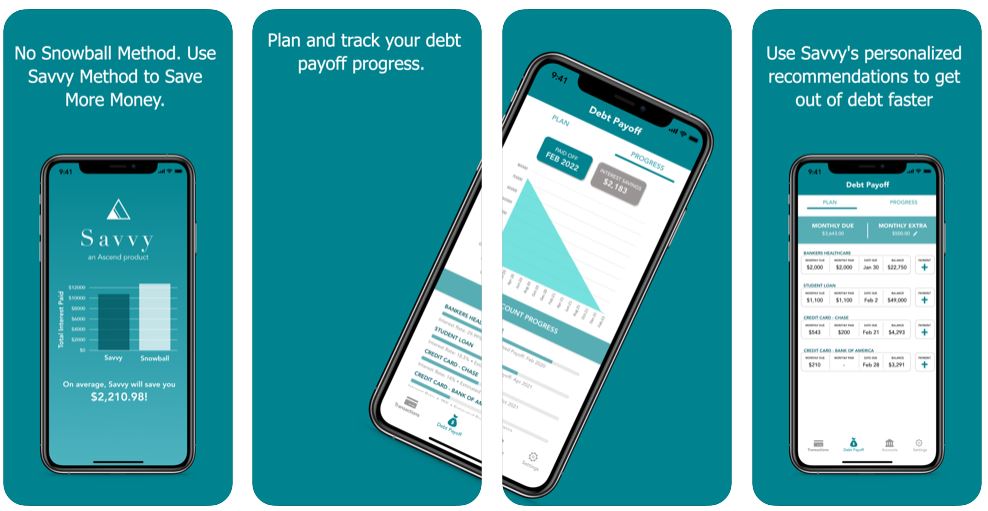

Today there were so many familiar apps that showed me so many things, like giving me a date when I would be debt-free and how much interest I could save over time using different methods. For me, I needed a tool to help me form a debt payoff plan I could execute successfully. Fortunately, Savvy Debt Payoff Planner is one of the best debt payoff planners I have come across.

What Really Goes Into Savvy Debt Payoff Planner That Works

This reputed app is pragmatically designed to help you repay all your debts and stay out of debt too. It can calculate, on your behalf, the smartest way to make monthly payments. And top of it they are absolutely user-friendly.

Amazingly it saves the average user over $2,000 using the Savvy debt payoff method versus the Snowball debt payoff method. Savvy debt payoff planner app is ad-free and uses automation to make your life simpler. It is practical and offers good judgments about how to pay off your debts better to achieve debt freedom once and for all.

Actionable Savvy Debt Payoff Planner Tips That Work like a Charm

Savvy conveys you what you pay and how much to pay towards each of your debts each month. Once your minimums are paid, Savvy debt payoff planner app will tell you where to put the extra money. The average user may save over $2,000 by using Savvy even after the monthly fee compared to using a debt payoff planner using the Snowball method based on recent study.

Savvy was built using proprietary Savvy debt payoff method. It’s not the snowball method or the avalanche method. Instead, the Savvy debt payoff method provides the psychological benefit from the Snowball method and the interest savings of Avalanche. It saves the average user over $2,000; you get out of debt faster. They shave a couple of months off of your debt freedom date together.

Pricing

For a limited time, try the Savvy app for free for 30 days followed by a monthly subscription of $5.99 (discounted from $9.99).

Crucial Tactics for Savvy Debt Payoff Planner

It allows users to add their accounts manually or automatically. Moreover Savvy is designed to serve the busy population by permitting you to add your accounts automatically by giving read-only access to view transactions via your bank account. If people wary about security and/or you’d like to control the process, you can also add your accounts and your transactions manually.

In addition Savvy protects your transaction information with read-only access and bank-level security via your financial institutions. Your data is safe which means it is not shared with third parties. Ascend connects to US financial institutions only.

Final Suggestion

More effectively the app Savvy Debt Payoff uses a debt payoff method that combines the best elements of two popular debt payoff strategies, the debt snowball, and the debt avalanche method. By using this app, on average, a person can save more than $2000. You will see why Savvy was ranked #1 as the best debt payoff app in 2020.