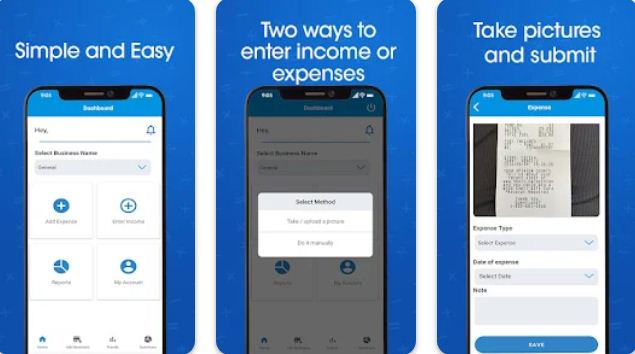

Zoombooks is an amazing app developed by instaccount which makes bookkeeping and expense management easy for drivers and self-employed people.It is a great app for business that helps you save time and money while keeping all your financials in check.

Key Features of Zoombooks

- Income and Expense recording by taking pictures (of receipts or invoices) or manually

- User notifications for posted transactions

- Receipts and invoices are digitally saved and organized

- Run reports to stay on top of your financials

- Download transactions data into Excel and CSV files

- Access transactions and data on web

- Receipt images can be viewed and downloaded

- Proper booking by pro bookkeepers

- Proper Sales tax (GST/HST/VAT) handling (calculates the sales tax receivable or payable)

- Stay tax time ready for CRA or IRS all the time

- Absolutely Zero knowledge of accounting required

No More Issues

- Shoe box receipts

- Having basic accounting knowledge

- Manual data entry

- Wrong categorization of expenses

- Unsure of expense treatment

- Character recognition errors and wrong entries

Use Cases

Scenario-1: As a driver (Uber, Lyft, truck, taxi etc.) you handle so many receipts every day, on the go. Don’t have time and place to save and organize those. You end up losing so many tax saving opportunities and risking tax audits.

Solution: Just taking a snap of your receipts on the go. The receipts will be saved, organized and recorded properly by Zoombooks. All you did was taking a picture and hit submit button.

Final Words

Zoombooks is an amazing app for bookkeeping and expense management. It is free and helps drivers and self-employed people save time and money. It eliminates the need of having basic accounting knowledge, manual data entry, and wrong categorization of expenses. All you have to do is take pictures of receipts and hit the submit button. Zoombooks will take care of the rest.